The Book Rich Dad Poor Dad - Changed My Understanding About Money

⊗ May 3, 2020 | read time: 3 min

Reference: Duckduckgo image search

Reference: Duckduckgo image search

Do you remember one event that flipped that mental switch in your brain? That one moment when the trajectory of your life changed. Looking back, how did it make you feel?

Mine happened to be a book. Rich Dad Poor Dad by Robert Kiyosaki was the book that did it for me. This one book single-handedly changed my perspective around money. Spear me a few minutes as I share my story, I hope you’ll be inspired to find your light-bulb moment.

How It All Begun

I love to learn. I’m like a sponge, get me close enough to any knowledge source and slush - I’ll absorve it. Being inquisitive is one of my strengths & weakness, but that was how I became aware of this book.

During my time at Medullan, two of my coworkers were having a conversation about books and other cool stuff. They were having a good time and I “somehow find my way into their conversation”. Vlad then mentioned this book he was sharing with his spouse. Instantly the other participant matched Vlad’s enthusiasm and the discussion blossomed. Vlad also mentioned a that is linked to the book game called cash flow. I then interrupted them to enquire about the purpose of this book. As you’d expect, I downloaded the free PDF on my phone before. And that is where it all started (according to my 512KB memory).

How It Changed My Life

I begun reading on my journey home from work. By the end of the night, I was hooked. It took me two days to finish it. The week ended but my addition didn’t. So I read it twice. Even though I read the free PDF version, every bit of information was priceless. They say getting tertiary-level knowledge is often costly (money & time). But this book is a true lifehack.

It is a tale of two boys, one with a father that was rich and the other with a father that was poor. The rich father learned how to make money worked for him. While the not-so-rich/poor father was highly educated and live on regular income. The the difference in teaching amongst the families and the outcome is the main theme of this wonderful book.

This book changed me in two fundamental ways, which I’ll get into.

First, let’s discuss the change in my mentality. As Robert said: “School doesn’t teach you about money”. I agree with him 100%. School taught me how to work for money. Having gone through primary, secondary & tertiary level, I can’t recall being taught about financing and how to think about money. Regurgitation was the name of the program. We took some value x and apply it to formula ax+b=c. This book came and flip the script. Now I mentally categorize all financially related matters into assets or liabilities. Robert then reinforces the principles by applying the gamification technique. The game (Cash Flow) seeks to imitate the monopoly game with a slight twist. A twist to help you understand the rat-race we’re in.

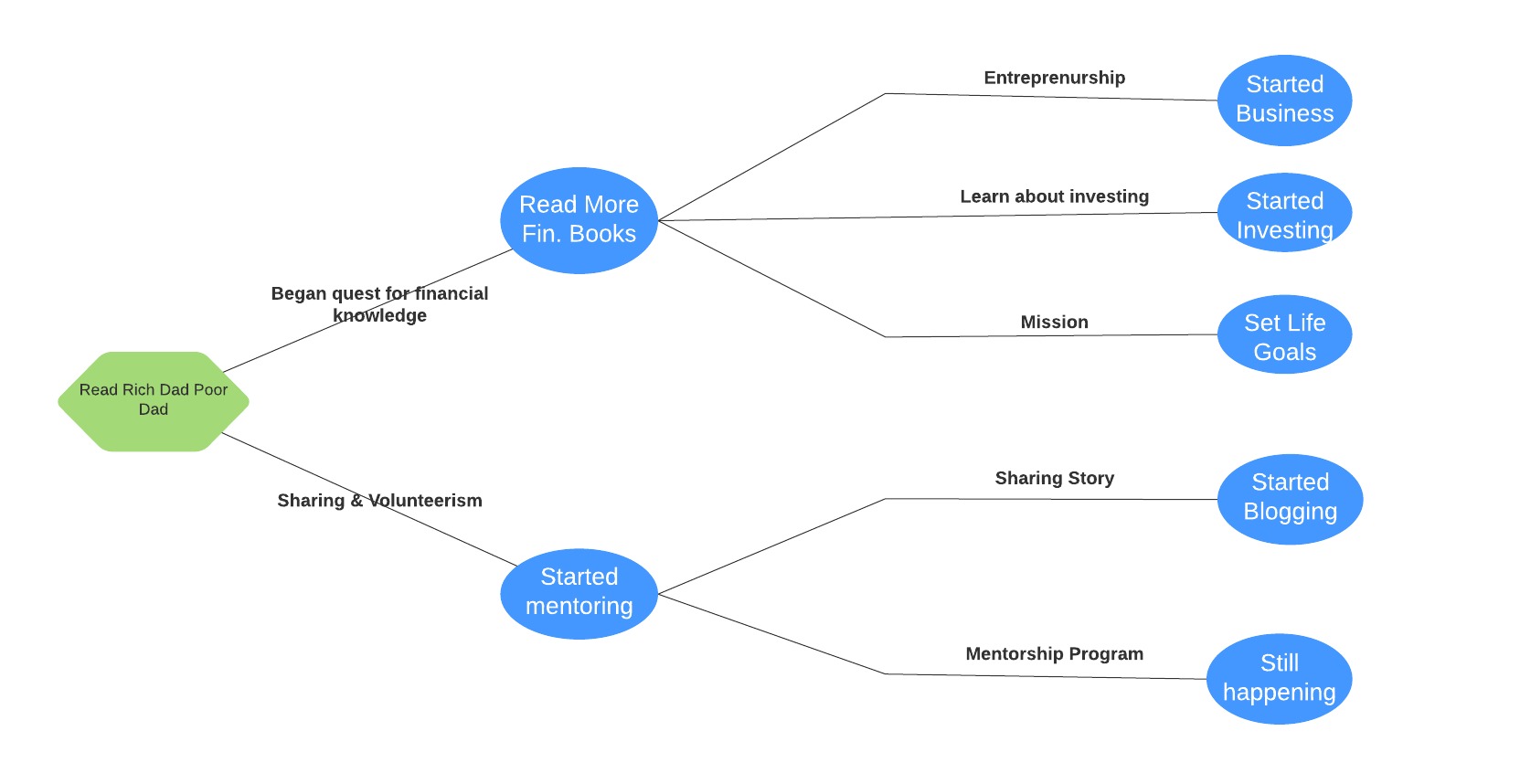

Being grateful, I went and repeatedly thanked Vlad for sharing. But that was just the beginning. I begun my quest for more knowledge and the results were transformational. I went on to read additional books related to assets, liabilities/debt, investment types, etc. Even started a proper budget, focusing on my long & short term goals. Later on, I got into a mentorship program. A few years later I even went and start a farming business. Even my off-grid project was influenced by the teachings of this one book.

Volunteerism is something I believed in and actively practice. I shared every bit - or byte- of knowledge with my friends; especially those in my rural community. Having regular discussions about money and how it impacts their lives became my weekend routine. Shortly after I started mentoring Jason. Within a few years, he became a success story in the community. Having not gone to high school, Jason was able to apply the simple teachings and he was on the road of becoming financially free. Even though he is no longer with us (😭), I’m proud to have witnessed his achievements. 😭 knowing that he had so much unrealized potential is very painful. I… somehow continue to… Let’s just leave it at that. RIP Jason.

The Education System Needs Fixing

Thankfully, I was blessed enough to overheard a conversation. What about the millions of people who don’t have a similar light-bulb moment? Would they make better decisions if they were armed with basic financial knowledge? Take the US for example, over 40% of residents are unable to survive a $1000 debt. I believe this research highlights the lack of basic financial knowledge.

I believe schools should teach proper financial management for all students. Starting at the primary level, we should equip students with an understanding of basic financial knowledge of life. Then continue that education up to the point of graduation. The most challenging aspect would be the lack of experience by educators. Teachers don’t have the experience in this area and therefore are unable to pass on these principles.

I’m not only echoing the teachings of Robert. The Bible makes mention that we need to understand debt and money - Proverbs 22:7. We can’t resolve a problem if you don’t understand it. Money is a big problem for us all. Families are being separated due to a lack of financial knowledge. And I thinkg that is a problem worth fixing.

Remember that knowledge is power.

Thank you, Vlad! Gratitude is a must, toast!